The following article provides a preliminary overview to blockchain technology. Additional information regarding this technology and its potential will be presented in subsequent articles. This information was presented in the Journal of Accountancy by Lou Carlozo:

Blockchain is one of the most popular—and controversial—topics of conversation among technology leaders in finance today. Many have called it revolutionary—a game-changing factor in the world of finance.

So what exactly do CPAs need to know about blockchain?

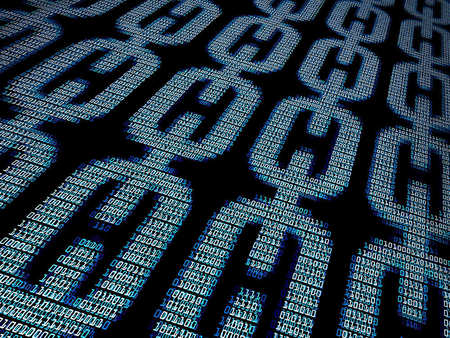

Essentially, as the Journal notes, blockchain is a digital ledger of economic transactions that is fully public, continually updated by countless users, and considered by many impossible to corrupt. It is a list of continuous records in blocks.

A blockchain database contains two types of records: transactions and blocks.

Blocks hold batches of transactions. The blocks are time-stamped and link to a previous block.

The transactions cannot be altered retroactively.

Here are four reasons finance executives and other CPAs should care about blockchain and its potential:

- Blockchain is much more than bitcoin. While many people in finance departments might mistake the mysterious and often volatile bitcoin for blockchain, they are two very different things. While invented to help transact in bitcoin, blockchain is the digital global ledger that not only records cryptocurrency transactions, but also provides a home for documents of all sorts. "Everything from property deeds, to birth records, to money such as bitcoin and various alt-coins resides on a blockchain backbone," said John Callahan, Ph.D., chief technology officer with Veridium, a company that specializes in advanced security technology. In fact, he described blockchain as "part of the iceberg beneath bitcoin."

- Blockchain could reshape the business of recordkeeping, and business itself. According to Jon Raphael, CPA, chief innovation officer at Deloitte. "As scalable applications are deployed—and if they live up to their potential—blockchain will profoundly change how records are kept and transactions are processed."

- Many finance executives are lagging behind their peers. A 2017 survey by Deloitte found that about 60% of big company executives said they were knowledgeable about blockchain.

- Blockchain is becoming a powerful way to do business. Because blockchain allows for the transacting and securing of digital data, it is beginning to realize its potential to aid in a wide range of areas, from compliance to data management. "It will bring enormous efficiency in business transactions besides making them military-gradesecure," said Nitin Narkhede, vice president and head of blockchain and innovation at Mphasis, a digital IT services company. "Hence, there is massive interest in experimenting with the technology and applying it in every business process.”

While all of the above is complex and intriguing, the truth is we’re just getting started with learning about blockchain technology. The potential and possibilities are extravagant to say the least. We look forward to discussing the topic in greater detail within future newsletters.